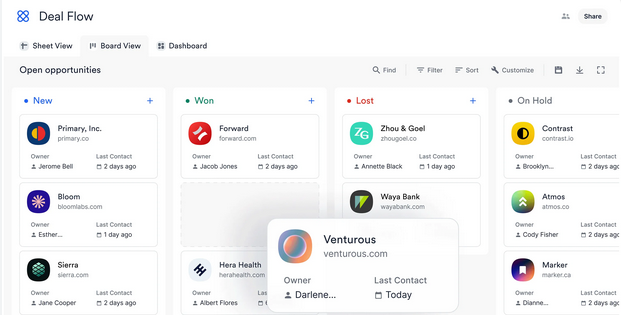

The company database, developed through the Kirchner Impact Initiative, is a valuable tool for deal flow purposes, but can also be used to visualize, evaluate, and identify the needs of a developing investment ecosystem in an efficient manner.

On average, in one year, a single Fellowship team will identify between 100-150 companies relevant to their investment mandate. These companies are logged in a database along with relevant information uncovered through diligence (kept confidential). This information can be used to attract additional impact investment into a region or community for place-based strategies. It also helps to inform technical assistance providers, incubators, accelerators, and those previously unaware of these opportunities.

In addition, it helps to facilitate the improvement in investment-readiness of companies by identifying critical gaps when used in tandem with our deal evaluation framework.